For default servicing firms, bankruptcy status updates and searches can be a time-consuming compliance requirement. With a variety of possible bankruptcy filing databases to research and time-sensitive file updates, it makes sense to automate this frustrating task with a reliable integration partner.

We’re looking at five of the biggest reasons that firms struggle with PACER searches and bankruptcy status compliance.

Time-Sensitive Searches

Default servicing firms know one thing for certain – never mess with a servicer’s deadlines. Missed dates for bankruptcy status checks or SCRA searches can yield damage to scorecards, lost referrals, and more bad news if it’s an ongoing issue.

Automation with integrated search functionality lets firms rest easy knowing these tasks are being completed and files are updated on schedule every time.

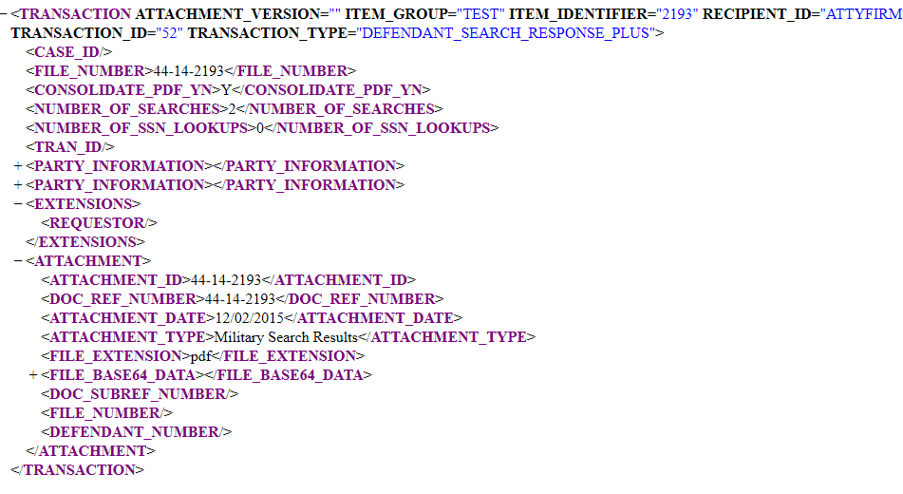

Missing Data for Borrowers

Often, firms can only work with what they’re given. By utilizing a PACER search service that includes access to SSN Finder, even incomplete data can yield important search results that might have otherwise been missed if not combined with deeper search functionality.

Our SSN Finder-assisted PACER searches, for example, can help find borrower bankruptcy data without a full SSN across both regional and national listings.

Labor-Intensive Detective Work

The variety of national and regional bankruptcy filing databases makes finding accurate borrower information hard, especially for borrowers who are still in the filing process. Regional filings may not have made it to national databases or may have been filed in an unexpected location.

Without a powerful integrated search option, this means at best an excess of human labor dedicated to playing the “private eye” for borrower files, and ensuring no stone goes unturned, or at worst missed results and miscategorized files.

Frequent Updates/Changes

We’ve worked with firms over the years who have chosen to leverage the PACER search APIs themselves with mixed success. Unfortunately, this often comes down to the resources required to maintain and support an integration of this scale and importance.

Online databases frequently make changes or updates to their APIs or connectivity schema, sometimes with little or no warning ahead of the change. In the last twelve months, the available PACER search endpoints had at least eight planned PACER-initiated maintenance windows that resulted in necessary changes and upgrades to retain functionality, plus countless unplanned slowdowns, errors, and more on the PACER API side that required investigation and troubleshooting.

This often yields panic and confusion for firms managing these connections and searches independently, as well as unavoidable downtime while updates are made. A good data integration partner for PACER is going to not only be able to respond quickly to major changes but effectively and accurately plan along the way so the solution remains up and running as often and as long as possible.

Input and Recording Errors

While there’s no replacement for human attention with certain tasks, transposing and inputting data just isn’t something humans are specialized for. Your team should be focused on critical thinking and analysis, not trying to replicate what good automation should do on its own – finding the right data, and accurately getting it where it needs to go.

Human searches and data entry are prone to inaccuracy, even with the best team in place. Let your firm’s employees focus on the work that needs a human touch.

Make the Change to an Automated and Integrated Bankruptcy Solution

PACER searches are just one of the things we handle here at NetDirector. We provide fully integrated solutions to default servicing firms beyond just integrating referrals – NetDirector has services for bankruptcy searches, military/SCRA status, death records, and a whole lot more. Contact us today to find out how else NetDirector can transform even your most complex data integration scenarios.

Overview

Overview Where we stand today

Where we stand today